New Year Nickel Market after LME Collapse in 2022

Post Time: 2023-01-09

News Overview

According to the report on January 6, 2023, March 2022 will be recorded in history at the time of the collapse of the global nickel market. The London Metal Exchange (LME) suspended nickel trading for six days, leaving the global supply chain in pricing darkness.

LME contract is the basis for manufacturers, users and traders to price a series of nickel products, from refined metal to ferronickel, to the new sulfate flow of electric vehicle batteries. Or at least they used to.

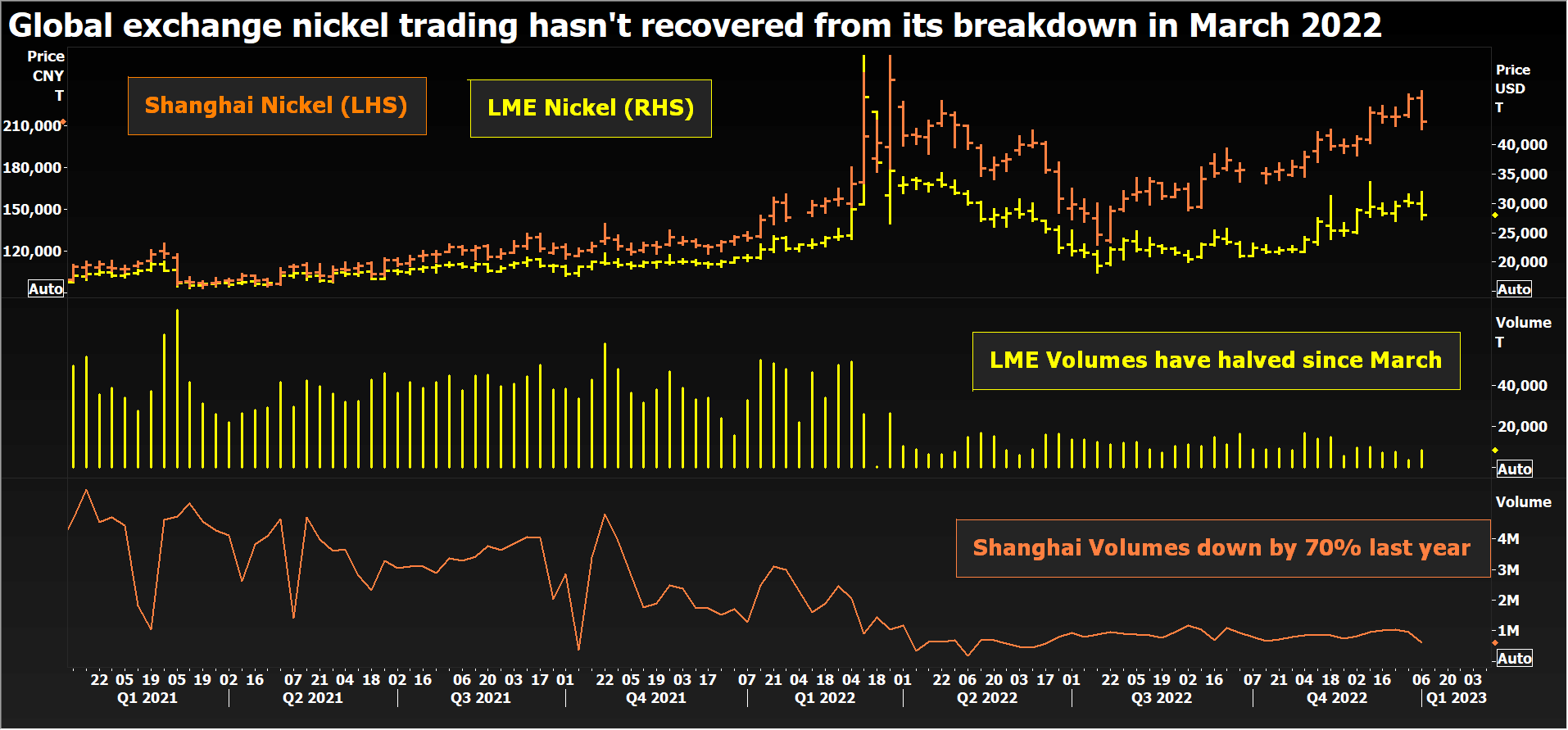

LME contracts have returned, but have been greatly reduced. Since March, the trading volume has almost halved, and the lack of liquidity has aggravated the continuous craziness of prices.

Don’t expect Shanghai to have an answer. The trading volume of the Shanghai Futures Exchange has seen a more obvious slump. Last year, the trading volume fell 70% due to the time difference fluctuation.

Global Commodity Holding Company (GCH) believes that it has a solution, that is, the impact of the London Metal Exchange (LME)’s own distant past may have a profound impact on industrial metal trading.

(LME and ShFE Nickel Price and Quantity)

01 Looking back

GCH operates global coal, which is a thermal coal and metallurgical coal trading platform with 3000 registered users. Market members include Anglo American, BHP Billiton, Jindal Stainless Steel, ArcelorMittal, Glencore, and Trafigura, all of which are significant players in the nickel supply chain.

GCH plans to replicate its spot coal index in the nickel market and launch the refined metals index at the end of the first quarter. All forms of Type I nickel will be traded on the company’s platform, but the spot index will be defined by lump and entire plate cathode (the two most liquid physical shapes).

The daily settlement price will be based on the orders and transactions of the previous two months and delivered to Baltimore, Jebel Ali, Amsterdam/Rotterdam/Antwerp, Singapore, Kaohsiung, Johor, Busan, and Shanghai. The minimum trading volume is 20 tons, equivalent to a container.

GCH is led by Martin Abbott, who served as the CEO of LME from 2006 to 2013, but the echo of the past is not limited to that. The pricing of GlobalCOAL refers to the physical goods transactions between producers, power operators, steel companies, and trading companies, which reminds us of the earliest days of LME itself.

When the London Metal Market was officially established in 1877, it was a way to price physical metal goods shipped to the world’s industrial powers at that time. The London Metal Exchange’s mysterious trading system still bears the imprint of its origin. The three-month benchmark prices of copper in Chile and tin in Malaysia were unusual and exceeded the delivery time.

The confusing multi-day rolling prompt system evolved from the vagaries of port arrival. The proposed new nickel index is a regression of these foundations in many aspects, which is a price discovery process based on physical transactions between industry participants with direct interests in the pricing game.

02 Future partners

GCH’s business model is to license its index to the futures exchange, which can expand the spot index into a fully tradable forward curve.

Its NEWCIndex is the benchmark reference point of thermal coal in the Asia Pacific region and is used as the settlement price of gC NEWC futures contracts traded and cleared in ICE Europe.

As the whole industry is looking for an alternative way to find the price of damaged LME contracts, if GCH’s nickel index can be established, there will be no shortage of futures partners in the future.

The Chicago Mercantile Exchange (CME. O) has been rapidly building its industrial metals portfolio, but strangely never offered nickel products.

LME itself may be a potential pursuer.

With the destruction of trading activities, it is increasingly possible for discontented funds to take legal action. It is difficult to see how the exchange can restore its reputation as a global nickel pricing place as soon as possible.

The relationship between the old lady of the metal trading and the old King Coal Company may be interesting.

03 Split the future

Abbott said in GCH’s announcement on December 22: “The price discovery process of spot nickel has been misplaced, and futures trading has had too much impact on the existing settlement process.”.

“There are very strong reasons to separate spot price discovery from futures price

He added: “It is very convincing to separate spot price discovery from futures market activities so that both functions can flourish.”.

It is self-evident that LME nickel contract is unable to absorb the short position scale accumulated by China Qingshan Group.

In fact, the fact that Aoyama’s large-scale nickel business could not produce the metal delivery volume specified in the LME contract aggravated the explosion.

However, Abbott’s view on the impact of futures trading on the pricing structure designed for the pre fund era may resonate more than the nickel market.

Since it was acquired by the Hong Kong Stock Exchange (HKEx) (0388. HK) in 2012, the London Metal Exchange (LME) has been actively pursuing the trading volume, and a large number of financial participants have poured in, many of whom are algorithmic traders and high-frequency traders.

Traditional industrial users are deterred by what they think is the improper influence of fund funds on pricing. This tension has led to numerous conflicts around the exchange’s efforts to modernize its trading system to accommodate financial newcomers.

Every normally functioning commodity market is based on the interaction of industrial hedging and speculation, but as Abbott pointed out, it does not have to be in the same place.

Especially when the site has liquidity on every date between cash and three months, and the warehouse inventory is decreasing.

In the past two years, wildness has permeated the LME metal kit. Copper will be included in special measures in October 2021 to forestall the risk of market chaos. Tin has been hit by unprecedented time difference.

Although the collapse of nickel pricing is extreme, it can be seen as part of a broader pattern of low inventories and increased speculation, thereby exacerbating price volatility.

For industrial metal users, the results are not satisfactory.

It may not be just the nickel industry that pays close attention to the new metal pricing scheme proposed by GCH.